Why You Might Regret Waiting For Better Rates After The Fed Cuts

This week’s labor market data and Fed speeches solidified the case for the Fed to cut rates by at least 0.25% when it meets in 2 weeks. With more and more buzz surrounding that rate cut, it’s only natural for consumers to enthusiastically wait for the lower mortgage rates that are sure to follow. All too often, those who wait are surprised to learn that the only rate that’s guaranteed to move lower on Fed day is the Fed Funds Rate.

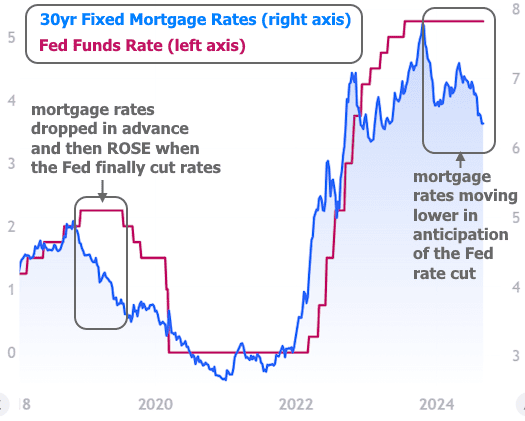

It’s not a case of mortgage rates needing time to respond either. In fact, it’s the Fed Funds Rate that will be getting caught up to the rest of the market. It is not an exaggeration to say that mortgage rates have already moved lower in anticipation of the upcoming Fed rate cut. After all, the average 30yr fixed rate is down more than 1.5% from the peak, hitting the lowest levels in more than a year and a half after Friday’s jobs report. Meanwhile, the Fed Funds Rate hasn’t dropped at all during the same time.

This is very normal. Because mortgage rates are based on bonds that have the luxury of moving every day, they are always able to get ahead of something like the Fed Funds Rate which only moves once every 6 weeks.

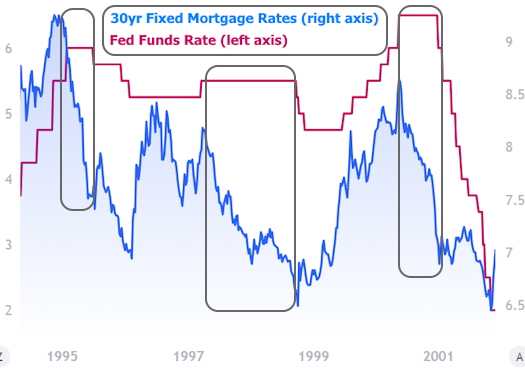

Consider some sobering lessons from the past. We’re focusing on the late 90s because that’s the next most recent series of cuts that didn’t involve an emergency like 2008 or 2020. In every case, mortgage rates moved decisively lower BEFORE the Fed cut rates. The aftermath is usually not good for those who wait. The best case scenario was in the middle of 1995 when consumers only had to wait 5 months before rates got back to pre-Fed levels. In 1998, however, borrowers who waited for the Fed ended up having to wait 4 more years before seeing the same rates.

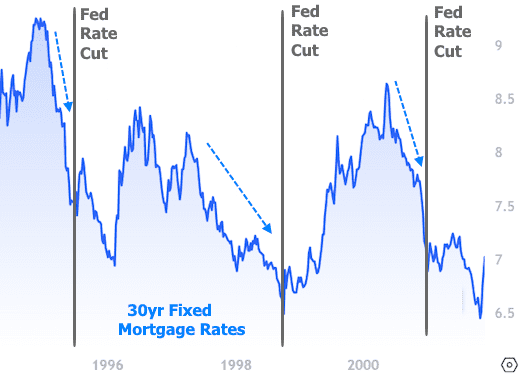

Here’s a slightly simpler way to look at the same data. The chart below only shows the Fed rate cuts as annotations on a chart of mortgage rates. This makes it easier to see what mortgage rates were doing just before and just after the Fed rate cuts.

This is not a sales pitch. It is a public service announcement intended to combat the misinformation that circulates around long-anticipated Fed rate cuts. Consider one last point on the notion of “waiting.” Those who wait are effectively placing a bet on rates moving lower than they are today. But here’s the thing about financial markets: if there is anything that can actually be known about the future, it can be traded today.

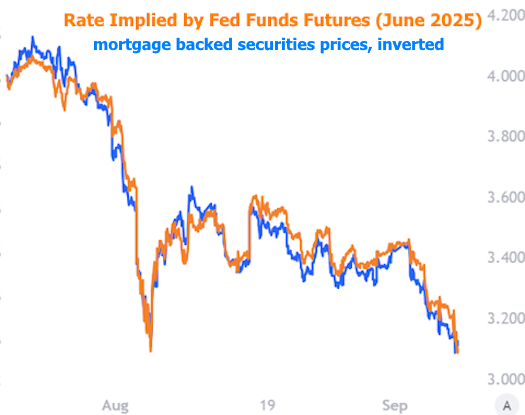

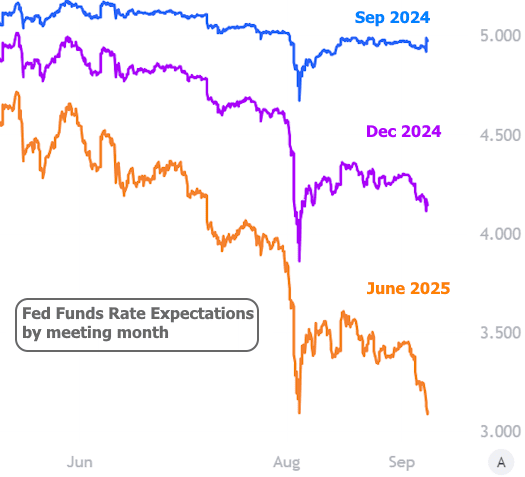

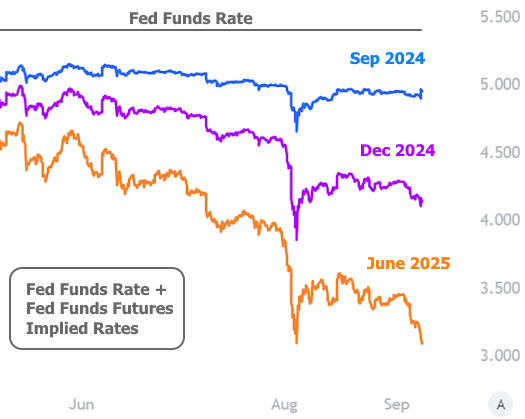

You may be wondering why the Fed Funds Rate has not moved lower already then. To reiterate last week’s message, the futures contracts used to bet on the Fed Funds Rate do indeed already show the lower rates that people are mistakenly waiting for. Those futures are the things that correlate with present day rate movement in a way the Fed Funds Rate can only dream of.

The following chart shows the rate implied by Fed Funds Futures. We use June 2025 because there’s been very little directional movement in September’s contract recently. Instead of mortgage rates, which are only updated once a day, we are using mortgage backed securities prices, which is what lenders use to determine mortgage rates each day.

In other words, if you think you are smarter than the market by waiting for a Fed rate cut, think again. The market has not only already traded it (thus causing mortgage rates to fall accordingly), but it will CONTINUE to trade it moment by moment on every business day based on new information that the Fed only has a chance to react to once every 6 weeks.

In “continuing to trade” the new information, almost anything can happen. There were moments in January 2024 where Fed Funds Futures saw the Fed Funds Rate being a full percent lower than it will be after the rate cut in 2 weeks. Data changed since then, so markets changed as well.

There is always more uncertainty the farther one moves into the future. Expectations for the September meeting haven’t moved much more than 0.25% in months. Contrast that to expectations for the June 2025 meeting, which moved that much just this week, and more than 1.5% since May 2024.

To reiterate, all of the movement in the chart above coincides with movement in mortgage rates that has ALREADY HAPPENED! All the while, the Fed Funds Rate can only wait for the Fed meeting.

There is an important caveat to all of the above, but it definitely cuts both ways: the rate cut at the upcoming Fed meeting is not the only thing that can move markets on Fed day. There will also be updated projections for future rates by each Fed member–something that’s notorious for causing volatility in the rate market. In addition, Fed Chair Powell may also discuss the potential pace of future rate cuts. The market has already shown its cards as seen in the charts above. The Fed could convey a more aggressive or conservative approach.

Beyond Fed day itself, perhaps more important is the ongoing stream of incoming economic data. If the economy were to deteriorate sharply, rates could certainly move even lower. Conversely, if economic data remains stable, rates could just as easily move back up. All that can be known about any of those futures is already reflected in today’s 1.5 year lows.